And since some SDIRAs including self-directed regular IRAs are subject to essential minimum amount distributions (RMDs), you’ll have to program forward to make sure that you may have ample liquidity to satisfy The foundations established because of the IRS.

Whether or not you’re a economic advisor, investment issuer, or other economic Specialist, check out how SDIRAs may become a strong asset to grow your small business and attain your Skilled objectives.

A self-directed IRA is really an unbelievably effective investment vehicle, but it surely’s not for everyone. As being the stating goes: with terrific electrical power will come excellent obligation; and with an SDIRA, that couldn’t be additional true. Continue reading to discover why an SDIRA could possibly, or won't, be in your case.

Better investment possibilities signifies it is possible to diversify your portfolio over and above stocks, bonds, and mutual resources and hedge your portfolio versus current market fluctuations and volatility.

No, You can't put money into your own personal enterprise having a self-directed IRA. The IRS prohibits any transactions between your IRA plus your individual organization because you, given that the proprietor, are regarded as a disqualified human being.

Minimal Liquidity: A lot of the alternative assets that may be held in an SDIRA, for instance real estate, private equity, or precious metals, might not be quickly liquidated. This can be an issue if you should entry cash immediately.

This consists of knowing IRS restrictions, running investments, and avoiding prohibited transactions that may disqualify your IRA. A lack of knowledge could result in pricey blunders.

Imagine your Pal is likely to be commencing the subsequent Fb or Uber? With an SDIRA, it is possible to spend money on causes that you believe in; and most likely enjoy larger returns.

Entrust can assist you in purchasing alternative investments with all your retirement cash, and administer the getting and promoting of assets that are generally unavailable by banking institutions and brokerage firms.

Shifting cash from a single type of account to another type of account, for instance shifting cash from the 401(k) important link to a conventional IRA.

Have the freedom to take a position in almost any type of asset that has a risk profile that fits your investment approach; including assets that have the prospective for an increased rate of return.

Set only, for those who’re looking for a tax efficient way to make a portfolio that’s more personalized towards your passions and skills, an SDIRA may be the answer.

Consequently, they tend not to market self-directed IRAs, which provide the flexibility to speculate in a very broader choice of assets.

Once you’ve observed an SDIRA supplier and opened your account, you may well be wanting to know how to actually get started investing. Comprehension each The foundations that govern SDIRAs, along with how to fund your account, may help to lay the inspiration for just a future of prosperous investing.

Opening an SDIRA can provide you with use of investments normally unavailable through a lender or brokerage company. Below’s how to begin:

In contrast to shares and see here now bonds, alternative assets are sometimes more difficult to offer or can come with rigorous contracts and schedules.

However there are lots of Added benefits associated with an SDIRA, it’s not with no its have drawbacks. Several of the popular reasons why investors don’t pick SDIRAs incorporate:

SDIRAs in many cases are utilized by palms-on buyers who will be willing to take on the challenges and tasks of selecting and vetting their investments. Self directed IRA accounts may also be great for traders which have specialised understanding in a niche industry they wish to put money into.

Complexity and Duty: By having an SDIRA, you have a lot more Regulate around your investments, but Additionally you bear far more accountability.

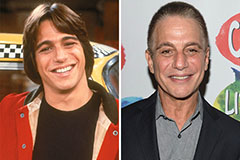

Tony Danza Then & Now!

Tony Danza Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!